TESTAMENTARY TRUST

- Peter Jones

- Oct 7, 2020

- 3 min read

Updated: May 9, 2024

WHAT IS A DISCRETIONARY TESTAMENTARY TRUST?

It is a trust created through your Will on your death to give your beneficiaries (the person(s) you leave gifts to) flexibility in dealing with the gift/s you give them. Briefly, you leave the gift/s in trust to be held by the trustee/s for the benefit of your nominated beneficiaries in accordance with your wishes as spelt out in your Will.

Generally, under a discretionary testamentary trust:

The beneficiary is usually the trustee of their own trust (so they have control over their inheritance). A third party can be appointed trustee in place of or in addition to the beneficiary if necessary. For example, where the beneficiary is facing bankruptcy, matrimonial problems or has limited capacity to manage their own affairs.

Usually few restrictions are placed on how the trustee can deal with the trust assets. The trustee (usually the beneficiary) will have total control unless restricted under the trust provisions. This flexibility is for tax purposes.

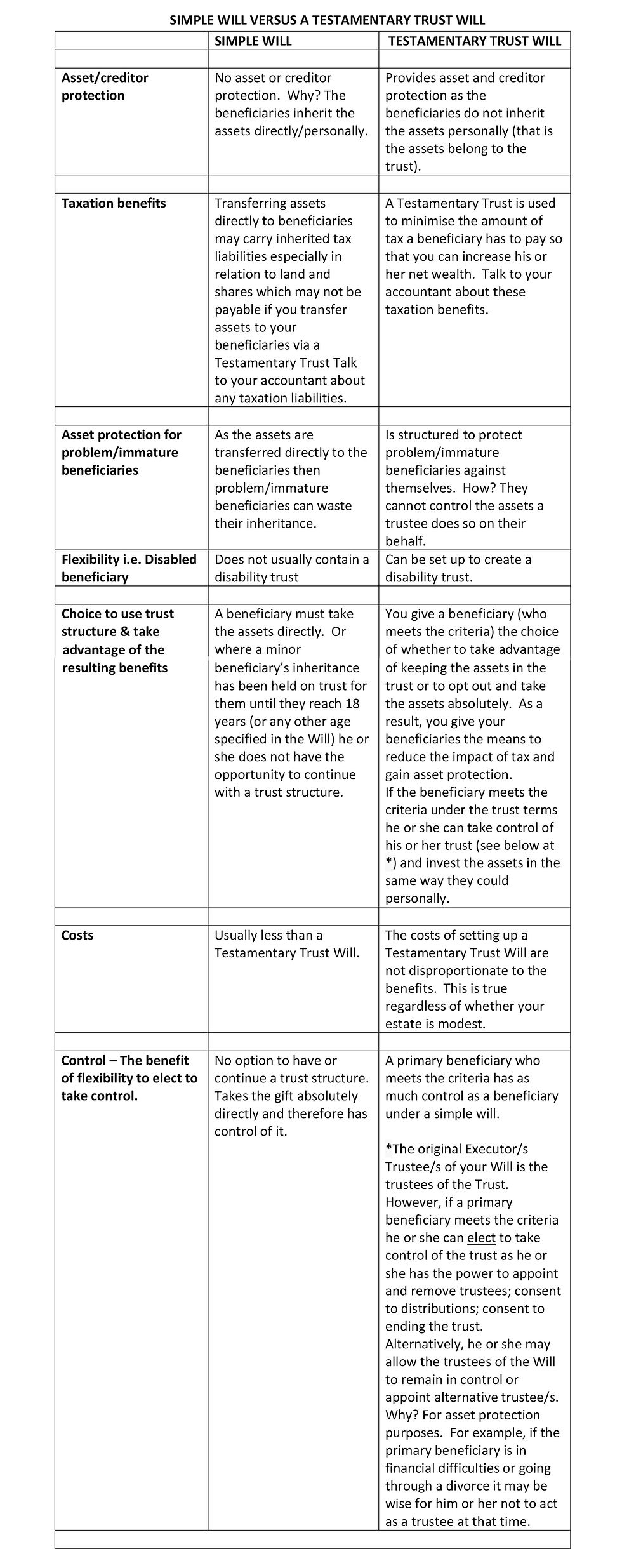

WHY A TESTAMENTARY TRUST WILL?

The main advantages are:

Taxation effectiveness – a Testamentary Trust can minimise the amount of tax a beneficiary pays. The discretionary power to distribute income/capital among a wide range of potential beneficiaries can result in considerable and continuing tax savings. Minors (children under 18 years) under a Testamentary Trust get the benefit of the same tax concessions as adults. That is a distribution from a Testamentary Trust is exempted from the penalty tax rates on minors. Talk to your accountant or other taxation expert about the tax benefits of a Testamentary Trust.

Asset protection general – The assets belong to the trust and not the beneficiary. As such the trust assets are protected from a beneficiary’s creditors (including the enforcement of any personal guarantees the beneficiary may have given), the effect of marriage breakdown (although it is difficult to protect assets of a beneficiary from being accessed by the court for matrimonial property settlement), the bankruptcy of a beneficiary. This can be important if a beneficiary is in a high-risk profession or in business.

Asset protection for problem beneficiaries – If a beneficiary becomes mentally incapacitated (including but not limited to drug addiction and alcoholism) control of the trust is not given to them until and only if the problem can be resolved. In this way, the trust gives protection to problem beneficiaries by protecting them against themselves, so they cannot waste their inheritance.

Asset protection for young/immature beneficiaries – A Testamentary Trust allows you to choose the minimum age a beneficiary can take control of his or her trust (i.e. 18, 21 or 25 or any other age you choose.). Prior to reaching that age, the assets must be held in trust for the benefit of the beneficiary. In this way, the trust gives protection to children who are minors and protects immature beneficiaries against themselves, so they cannot waste their inheritance.

Disabled beneficiaries – A Testamentary Trust can be set up to protect someone with a disability. This is a specialist area and other forms of trust such as a Special Disability Trust” may apply. will be happy to discuss your requirements with you.

The main disadvantage is the perceived complexity of a Testamentary Trust Will. Our specialist assistance and knowledge ensure that this is explained in simple terms as to how a testamentary trust works.

AN OBVIOUS SITUATION WHERE A TESTAMENTARY TRUST SHOULD NOT BE USED Do not use a Testamentary Trust Will for simple situations where there are no family interests to protect, for example where the whole estate is to go to charity.

For further information contact our team on (08) 9368 1337

Information provided by Willcraft Estate Planning Pty Ltd, An Incorporated Legal Practice.

Comments